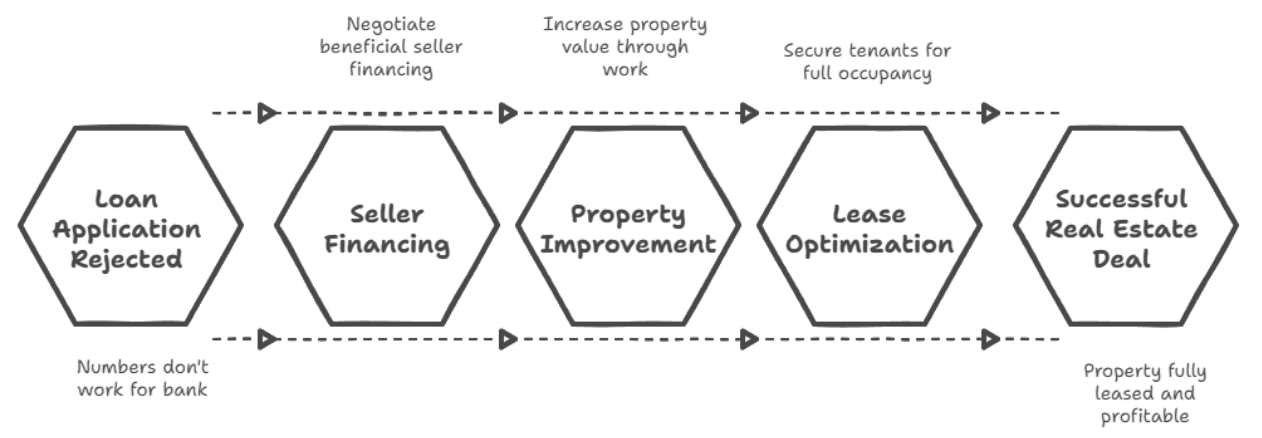

I still remember sitting across from a banker three years ago, watching him slide my client’s loan application back across the table with that apologetic look they all seem to master. “Great property,” he said, “but the numbers just don’t work for us right now.” My client had stellar credit, significant cash reserves, and a solid business plan for a mixed-use building in an up-and-coming neighborhood. But the property needed work, the current vacancy rate was higher than the bank’s comfort zone, and – well, you know how this story goes.

That rejection actually turned into one of our most successful deals. We ended up structuring a seller financing arrangement that gave my client better terms than the bank would have offered anyway. The property is now fully leased, worth 40% more than we paid, and generating consistent cash flow. But here’s the thing – none of that would have happened if we’d given up after the bank said no.

Traditional financing has become increasingly restrictive over the past few years. Banks want perfect deals: stabilized properties, pristine credit scores, substantial down payments, and borrowers with extensive track records. That’s their job – managing risk for their depositors. But their risk management often means missing opportunities that creative investors can capitalize on.

The truth is, some of the best commercial real estate deals I’ve seen couldn’t get traditional financing. The properties that banks love – fully leased, recently renovated, in prime locations with AAA tenants – often don’t offer the returns that make commercial real estate exciting. It’s the deals that require vision, work, or unconventional approaches that create real wealth.

Why Banks Keep Saying No

Banks have gotten increasingly conservative, and for understandable reasons. Commercial real estate lending got many institutions in trouble during the last recession, and regulatory scrutiny has only intensified since then. They’re looking for deals that fit neatly into their underwriting boxes: loan-to-value ratios under 75%, debt service coverage ratios above 1.25, and borrowers with significant liquidity reserves.

But here’s what’s frustrating – many of the deals that don’t meet these criteria aren’t actually riskier. They’re just different. A property that’s 60% occupied but in a strong market with below-market rents might be a fantastic opportunity. An experienced investor buying their first commercial property might be a better bet than someone with a mediocre track record. Banks have trouble recognizing these nuances because they’re working within rigid guidelines.

The approval timeline is another killer. I’ve seen deals fall apart because banks took 45-60 days to get through their approval process. In today’s competitive market, sellers often won’t accept offers contingent on lengthy financing approval periods. By the time the bank says yes, the deal is gone.

Value-add opportunities are particularly challenging for traditional lenders. Banks prefer predictable cash flows from stabilized properties. A building that could double its income with the right improvements looks risky to a loan committee, even when the potential is obvious to experienced investors.

The Creative Financing Toolkit

Seller Financing: The Win-Win Solution

Seller financing has become my go-to strategy for deals that don’t fit traditional lending criteria. Essentially, the property owner becomes your lender, accepting payments over time instead of a lump sum at closing. This arrangement can benefit both parties significantly.

For buyers, seller financing offers speed and flexibility. No bank approval process, no lengthy underwriting, and terms that can be negotiated to fit the specific deal. For sellers, it can mean a higher sale price, steady income stream, and significant tax advantages by spreading the gain over multiple years.

I recently used seller financing to help a client acquire a small office building where the owner was retiring. The property was well-maintained but had some deferred maintenance issues that made banks nervous. The seller was more interested in steady monthly income than a large lump sum, so we structured a deal where he financed 60% of the purchase price at 6% interest over 15 years.

The key to successful seller financing is understanding what motivates the seller. Are they looking for steady income? Trying to minimize taxes? Struggling to find qualified buyers? Once you understand their priorities, you can structure terms that address their needs while achieving your investment goals.

Private and Hard Money: Speed When You Need It

Private lenders and hard money lenders fill a crucial gap in the commercial financing market. While their rates are higher – typically 8-15% compared to 4-7% for bank loans – they offer speed and flexibility that can make the difference between winning and losing a deal.

I use private money primarily for two situations: time-sensitive acquisitions and properties that need significant work before they’ll qualify for traditional financing. Bridge loans from private lenders can help you acquire a property quickly, complete necessary improvements, and then refinance with a bank at lower rates.

The relationship aspect is crucial with private lenders. These are often individuals or small groups investing their own money, so trust and communication matter more than with institutional lenders. I’ve found that being transparent about risks, providing detailed business plans, and following through on commitments builds relationships that lead to better terms and repeat funding opportunities.

One thing to watch with hard money loans: make sure your exit strategy is realistic. These loans typically have terms of 12-36 months, and you need a clear plan for either refinancing or selling before the loan matures. I’ve seen investors get into trouble by assuming they could easily extend these loans when markets shifted.

Joint Ventures: Leveraging Other People’s Resources

Joint ventures can be powerful tools for accessing both capital and expertise. The basic concept is simple: you partner with someone who has what you lack, whether that’s money, experience, or market knowledge.

I’ve structured JVs in various ways. Sometimes it’s a capital partner who provides funding in exchange for a percentage of the profits. Other times it’s an operating partner who handles property management while you provide the acquisition and financing expertise. The key is ensuring that each partner brings real value to the deal and that the profit-sharing arrangement reflects those contributions.

One successful JV I facilitated involved a young investor with great market knowledge but limited capital, and a doctor looking to diversify his investment portfolio. The investor identified undervalued properties and managed the acquisition and improvement process, while the doctor provided the capital. They split profits 50/50 after the doctor received a preferred return on his investment.

Clear documentation is essential for JVs. I always recommend having detailed operating agreements that specify each partner’s responsibilities, decision-making authority, and profit distribution. It’s also important to plan for exit scenarios – what happens if one partner wants out, or if you disagree on major decisions?

Lease Options: Controlling Property with Minimal Capital

Lease options give you the right to purchase a property at a predetermined price within a specific timeframe, while leasing it in the interim. This strategy allows you to control a property with minimal upfront investment and test its potential before committing to purchase.

I’ve used lease options successfully in situations where property owners were motivated to sell but weren’t in a hurry. For example, a building owner approaching retirement might be willing to lease their property with an option to purchase, providing them with steady income while giving you time to evaluate the property’s potential and arrange financing.

The option consideration – the upfront payment for the purchase right – is typically credited toward the purchase price if you exercise the option. Lease payments may or may not be credited, depending on how you structure the deal. The key is ensuring the option price is fair based on current market conditions while giving you enough time to execute your business plan.

Subject-To: Proceed with Extreme Caution

Taking title “subject to” existing financing means buying a property while leaving the seller’s mortgage in place. This strategy can provide access to below-market interest rates and minimal down payment requirements, but it comes with significant risks.

The biggest risk is the due-on-sale clause that exists in most commercial mortgages. This clause gives the lender the right to call the loan immediately if the property is sold. While lenders don’t always exercise this right, they can, and it could force you to refinance or face foreclosure.

I rarely recommend subject-to strategies for commercial properties, but they can work in specific circumstances with proper legal guidance. The key is understanding all the risks and having contingency plans. Never attempt this strategy without consulting with an experienced real estate attorney.

Real-World Success Stories

Turning Around a Struggling Retail Center

Last year, I worked with an investor who wanted to acquire a small retail center that was about 40% vacant. The property was in a good location, but poor management and deferred maintenance had created a negative spiral. Banks wouldn’t touch it because of the low occupancy rate and the capital needed for improvements.

We approached the seller with a creative financing proposal. Instead of seller financing the entire purchase price, we structured a deal where the seller financed 50% at a favorable rate, and my client brought in a private lender for the remaining capital needed for acquisition and improvements.

The interesting twist was that we tied the seller financing terms to performance milestones. As my client successfully leased vacant spaces and completed specific improvements, the interest rate on the seller note decreased. This aligned everyone’s incentives and gave the seller confidence in my client’s ability to turn the property around.

Within 18 months, the property was 95% leased, the improvements were complete, and my client refinanced the entire project with a traditional bank loan at favorable terms. The seller received steady payments and ultimately got paid off sooner than expected. It was a genuine win-win situation that created value for everyone involved.

Joint Venture Office Building Acquisition

Another successful deal involved an office building that needed significant capital improvements to compete with newer properties in the market. My client had identified the opportunity and had the expertise to manage the renovation, but needed a capital partner.

I connected him with a family office that was looking for commercial real estate investments. We structured a joint venture where the family office provided 70% of the capital in exchange for 70% of the profits after achieving a 12% preferred return. My client contributed 30% of the capital plus his expertise in managing the renovation and leasing.

The project took two years to complete, but the results exceeded everyone’s expectations. The property’s value increased by 85%, and both partners achieved returns well above their targets. More importantly, my client established a relationship with the family office that has led to additional investment opportunities.

Managing the Risks

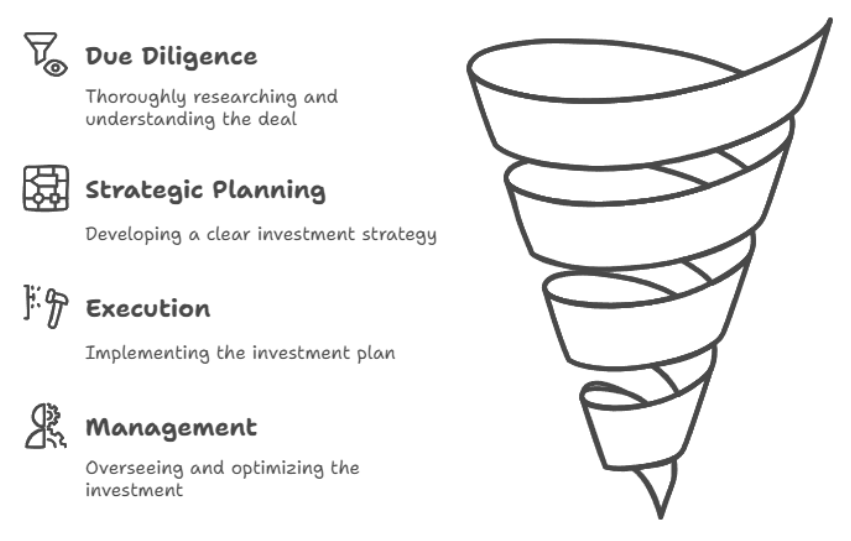

Creative financing strategies often involve higher risks than traditional bank loans, but these risks can be managed with proper planning and due diligence. The key is understanding what you’re getting into and having contingency plans for various scenarios.

Higher interest rates are the most obvious risk with alternative financing. Private lenders and hard money lenders charge more because they’re taking more risk and providing more flexibility. The key is ensuring that your investment can generate enough cash flow to service the debt while still providing acceptable returns.

I always recommend stress-testing your financial projections with higher vacancy rates, lower rents, and higher expenses than you expect. If the deal still works under these conservative assumptions, you’re probably in good shape. If it only works with optimistic projections, you might want to reconsider or restructure the terms.

Legal risks can be significant with creative financing arrangements. These deals often involve more complex documentation and less standardized terms than traditional bank loans. Always work with experienced real estate attorneys who understand these transactions and can protect your interests.

Exit strategy planning is crucial, especially with short-term financing like hard money loans. Know how you’ll refinance or sell the property before you need to, and have backup plans if your primary strategy doesn’t work out. Market conditions can change, and you don’t want to be forced into a bad situation because you didn’t plan ahead.

Building Your Creative Financing Network

Success with creative financing depends heavily on relationships. You need a network of private lenders, experienced attorneys, knowledgeable brokers, and potential joint venture partners. Building these relationships takes time, but it’s one of the most valuable investments you can make.

I spend significant time attending industry events, joining real estate investment groups, and maintaining relationships with past clients and partners. When opportunities arise, I can quickly connect buyers with appropriate financing sources and structure deals that work for everyone involved.

Private lenders, in particular, prefer working with people they know and trust. Start building these relationships before you need them. Be transparent about your experience level and investment goals. Most successful private lenders appreciate honesty and are often willing to mentor newer investors who show genuine commitment to learning and growing.

The Bottom Line

Creative financing isn’t just about finding alternatives when banks say no – it’s about expanding your options and accessing opportunities that others miss. Some of the best commercial real estate deals require creative approaches, whether because of timing, property condition, or unique circumstances.

The key is understanding these strategies thoroughly, managing the risks appropriately, and building relationships with people who can help you execute successfully. Don’t let traditional financing limitations prevent you from pursuing promising opportunities. With the right knowledge and network, there’s almost always a way to structure a deal that works.

Remember, though, that creative doesn’t mean reckless. These strategies require more sophistication and careful planning than traditional financing. Do your homework, work with experienced professionals, and always have backup plans. The extra effort is worth it when you’re able to acquire and improve properties that generate exceptional returns.