Commercial real estate – honestly, it’s one of those industries that sounds intimidating until you’ve been in it for a while. Then it becomes… well, still intimidating, but in a good way. The potential returns can be remarkable, sometimes hitting numbers that make traditional stock market investments look pretty modest in comparison. But here’s the thing that keeps me up at night when working with new clients: the gap between what looks like a great opportunity and what actually delivers results.

I’ve watched too many investors get swept up in the excitement of a deal without truly understanding what they’re walking into. The commercial real estate lifecycle isn’t just about finding a property and writing a check – though I wish it were that simple. It’s a methodical process that, when done right, can set you up for years of solid returns. When done wrong? Well, let’s just say I’ve seen some expensive learning experiences.

The truth is, every successful commercial real estate transaction follows a fairly predictable path, but the devil is absolutely in the details. And that’s what we’re going to walk through here – the real process, the actual challenges, and the strategies that actually work in today’s market.

Getting Your Head Right: Investment Criteria and Property Search

What Do You Actually Want?

Before you even start scrolling through property listings (and trust me, that rabbit hole is deep), you need to get brutally honest about your goals. I mean really honest. Not the goals you think you should have, or the ones that sound impressive at cocktail parties, but the ones that match your actual situation.

Are you looking for steady monthly income? Some of my most successful clients are the ones who prioritize cash flow over appreciation – they want properties that pay them consistently, month after month. Others are more interested in the long game, buying undervalued properties in emerging markets and waiting for appreciation. There’s no right answer, but there’s definitely a wrong one: not knowing which camp you’re in.

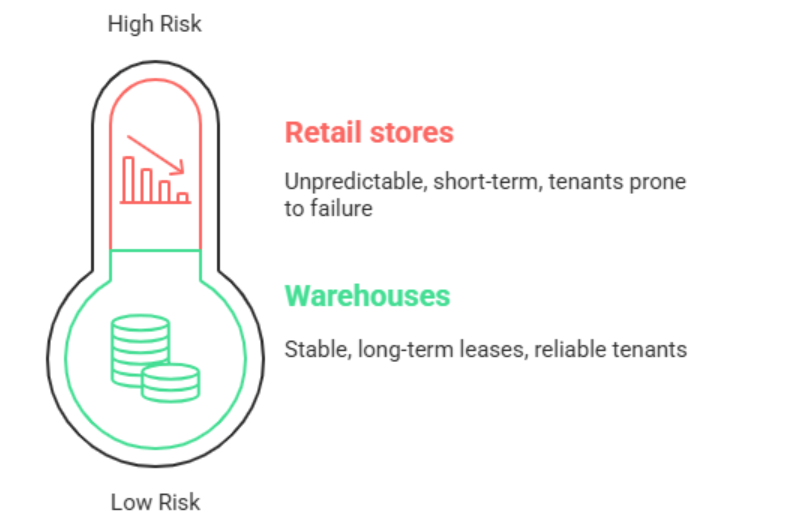

Your risk tolerance matters more in commercial real estate than almost any other investment class. I’ve seen investors who thought they could handle the stress of a major renovation project, only to discover that three months of contractor delays and budget overruns made them question every life choice that led them to real estate. On the flip side, some clients thrive on that kind of challenge.

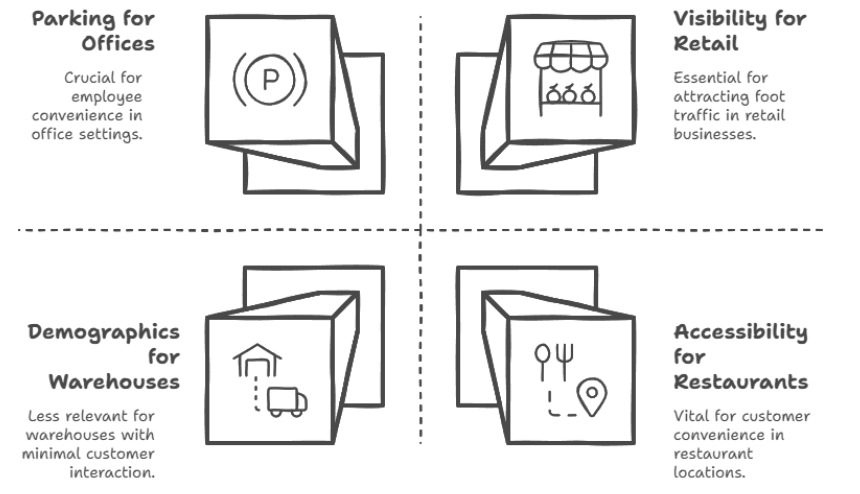

Here’s something that doesn’t get talked about enough: your personality type really does matter in property selection. If you’re someone who needs control and wants to be involved in every decision, a triple-net lease property where the tenant handles everything might drive you crazy. If you travel constantly for work, a property that requires hands-on management is probably a terrible fit.

The Hunt: Finding Properties That Make Sense

Once you’ve got your criteria straight, the real work begins. And here’s where I see a lot of people make their first big mistake: falling in love with online listings.

Don’t get me wrong – platforms like LoopNet and Crexi are useful tools. I check them regularly, and they’re great for getting a sense of what’s available in a market. But the best deals? They often never make it to these platforms. The really good stuff gets snapped up through broker networks and word-of-mouth before it ever hits the public listings.

Building relationships with commercial brokers isn’t just helpful – it’s essential. But here’s the thing about brokers: they’re busy people working with multiple clients, and they’re going to prioritize the investors who they know can actually close deals. That means being responsive, asking intelligent questions, and demonstrating that you’re serious and qualified.

I’ve found that the most effective approach is to be very specific about what you’re looking for. Instead of saying “I want commercial real estate,” try something like “I’m looking for office buildings between 5,000 and 15,000 square feet in the downtown corridor, with occupancy rates above 85%, priced under $200 per square foot.” Brokers appreciate specificity because it makes their job easier.

Money Talks: Financing and Deal Structure

The Financing Landscape

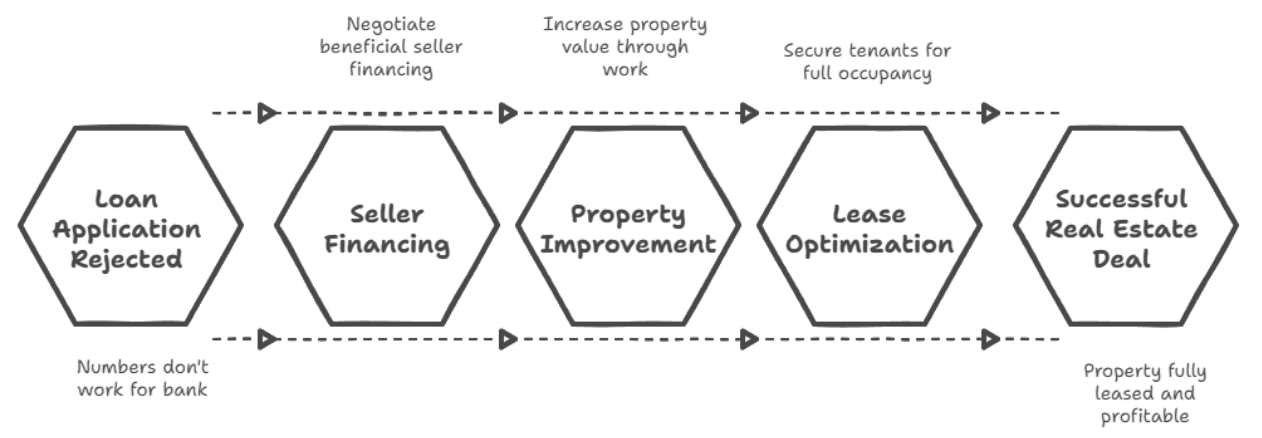

Let’s be honest about financing: it’s probably going to be more complicated than you expect, take longer than you want, and require more documentation than seems reasonable. But understanding your options can make the difference between getting a deal done and watching it slip away.

Traditional bank financing is often the most cost-effective option, but banks have gotten increasingly conservative over the past few years. They want to see strong credit scores, substantial down payments (typically 20-30%), and solid debt-to-income ratios. The upside is competitive interest rates and longer amortization periods. The downside is a process that can feel like a financial colonoscopy.

SBA loans can be a game-changer for smaller deals, especially if you’re buying a property for your own business. The SBA 504 program, in particular, allows for lower down payments and fixed rates on a portion of the loan. But the paperwork is extensive, and the approval process can be slow. I’ve seen deals take 90+ days to close with SBA financing, which doesn’t work if you’re competing against cash buyers.

Private lenders have become increasingly popular, especially for investors who need to move quickly or don’t fit the traditional bank mold. Yes, you’ll pay higher rates – sometimes significantly higher – but the speed and flexibility can be worth it. I’ve seen private lenders close deals in two weeks that would have taken a bank two months.

Structuring for Success (and Tax Efficiency)

The entity structure you choose for holding commercial real estate can have massive implications for taxes, liability protection, and future flexibility. This is one area where cutting corners to save on legal fees almost always backfires.

LLCs have become the default choice for most commercial real estate investors, and for good reason. They provide liability protection, pass-through taxation, and operational flexibility. But the tax election you make for your LLC – whether it’s taxed as a sole proprietorship, partnership, S-corp, or C-corp – can dramatically impact your bottom line.

I’ve seen investors save tens of thousands of dollars annually by making the right tax elections. The S-corp election, for example, can help reduce self-employment taxes on distributions, though it comes with additional compliance requirements. Partnership structures can be beneficial when you have multiple investors with different contributions and risk profiles.

Due Diligence: Where Deals Live or Die

Understanding the Numbers

Financial analysis in commercial real estate goes way beyond just looking at the asking price and calculating a monthly payment. You need to understand how the property actually performs, not just how it’s supposed to perform on paper.

Net Operating Income (NOI) is your friend – it’s the truest measure of a property’s profitability because it accounts for all operating expenses but isn’t affected by financing decisions. But here’s what they don’t teach you in real estate seminars: seller-provided financials are often optimistic at best, and sometimes completely unrealistic.

I always recommend doing your own rent roll analysis. Call comparable properties in the area and ask about their rental rates. Check with local commercial brokers about market rents. Look at actual lease agreements, not just summaries. I’ve seen deals where the “market rent” listed on the property summary was 20-30% higher than what similar properties were actually getting.

Vacancy rates deserve special attention. A property showing 95% occupancy looks great on paper, but what if three major tenants are on month-to-month leases? Or what if the largest tenant hasn’t paid rent in two months but technically hasn’t been evicted yet? These scenarios happen more often than you’d think.

The Deep Dive: What Due Diligence Really Means

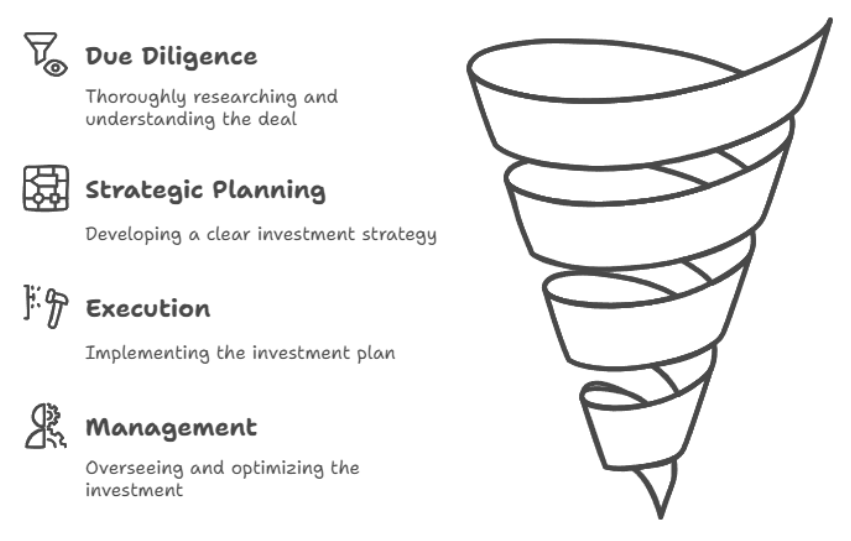

Due diligence is where you find out if that promising property is actually what it appears to be. It’s also where you’ll discover whether you’re buying someone else’s problems along with their building.

Property inspections for commercial real estate are a different beast than residential inspections. You’re not just looking for cosmetic issues – you’re evaluating major building systems that could cost hundreds of thousands to replace. HVAC systems in commercial buildings are complex and expensive. Electrical systems need to handle significant loads. Roofing on a 20,000 square foot building isn’t something you patch with a tube of caulk.

I’ve learned to budget for inspection surprises. Even on properties that look well-maintained, inspectors often uncover issues that weren’t obvious during initial walkthroughs. That beautiful brick facade might be hiding structural problems. The “recently updated” electrical system might not actually be up to current codes.

Environmental assessments can be deal-killers, especially for older properties or those in industrial areas. Phase I environmental assessments are standard, but sometimes they recommend Phase II testing, which involves actual soil and groundwater sampling. I’ve seen environmental issues add months to a transaction timeline and six-figure remediation costs.

Title issues are another area where deals can go sideways quickly. Most title problems are minor and can be resolved, but occasionally you’ll encounter something significant – an undisclosed easement, an outstanding lien, or even disputed ownership. This is why title insurance exists, but it’s better to identify these issues early in the process.

Avoiding the Big Mistakes

The Price Trap

Overpaying is probably the most common mistake in commercial real estate, and it’s also the hardest to recover from. Unlike residential real estate, where you might buy a house for your family and care less about the investment return, commercial properties are purely financial decisions. Overpay, and it affects your returns for the entire time you own the property.

Market comparable analysis in commercial real estate requires more sophistication than pulling recent sales from a website. Commercial properties are unique in ways that residential properties often aren’t. A 10,000 square foot office building with 15 tenants is very different from a 10,000 square foot office building with 3 tenants, even if they’re across the street from each other.

I’ve found that professional appraisals are worth the cost, especially for larger deals. A good commercial appraiser will use multiple valuation methods – comparable sales, income approach, and replacement cost – to arrive at a defensible value. But even appraisals can be off, so I always recommend doing your own analysis as well.

The Hidden Costs That Kill Deals

Repair and renovation costs are notorious for exceeding initial estimates. What looks like a simple roof repair turns into a full replacement. What seems like cosmetic updates reveals electrical and plumbing issues that require major work.

The key is getting detailed estimates from qualified contractors before you close, not after. Yes, this means spending money upfront on inspections and contractor consultations, but it’s money well spent. I typically recommend getting at least three estimates for any major work, and then adding a 20% contingency on top of the highest estimate.

Labor costs and material costs have been particularly volatile in recent years. A renovation estimate you received six months ago might no longer be accurate. Supply chain disruptions, labor shortages, and inflation have all impacted construction costs in ways that weren’t predictable even a few years ago.

Zoning: The Silent Deal Killer

Zoning issues are insidious because they often don’t surface until you’re well into the process of planning changes to a property. You might buy a building assuming you can convert office space to retail, only to discover that the zoning doesn’t permit retail use.

Grandfathered uses add another layer of complexity. A property might be operating under a grandfathered use that would be prohibited under current zoning. This is fine as long as you continue that use, but if you want to change uses or significantly renovate the property, you might lose those grandfathered rights.

Negotiation and Contracts: Getting to Yes

The Art of Commercial Negotiation

Negotiating commercial real estate deals is different from negotiating residential purchases. The stakes are higher, the parties are often more sophisticated, and there are usually more moving parts to consider beyond just price.

Understanding the seller’s motivation is crucial. Are they facing a deadline? Do they need to close quickly for tax reasons? Are they dealing with lender pressure? Sometimes a seller will accept a lower price in exchange for a faster closing or fewer contingencies. Other times, they’ll hold out for top dollar even if it means waiting months for the right buyer.

Purchase Agreements: Getting the Details Right

Commercial purchase agreements are substantially more complex than residential contracts. There are more contingencies to consider, more representations and warranties to negotiate, and more opportunities for misunderstandings that could derail the deal.

Financing contingencies need to be specific about the type of financing you’re seeking, the interest rate parameters you’ll accept, and the timeline for loan approval. Vague financing contingencies can give sellers grounds to cancel if you’re having trouble getting approved.

Inspection contingencies should specify not just the right to inspect, but also the scope of inspections you plan to conduct. Environmental assessments, structural engineering reports, and specialized systems inspections should all be contemplated in the agreement if they’re relevant to your due diligence plan.

Assignment clauses can be important if you’re buying through an entity that hasn’t been formed yet, or if you might want to bring in partners before closing. Some sellers resist assignment rights, fearing that you’re trying to flip the contract, while others are fine with it as long as the assignee is qualified to close.

Closing: The Home Stretch

Making It to the Finish Line

The closing process for commercial real estate transactions feels like it takes forever, even when everything goes smoothly. There are just so many moving parts – financing, title work, inspections, document preparation, and coordination between multiple parties. Something always seems to come up at the last minute.

Title insurance is more complex for commercial properties than residential ones. The coverage amounts are higher, the underwriting is more detailed, and the potential issues are more varied. Commercial title policies often include specific endorsements for things like zoning compliance, access rights, and environmental protection. These endorsements cost extra but can provide valuable protection.

The final walkthrough serves a different purpose in commercial transactions than residential ones. You’re not just checking that the property hasn’t been damaged – you’re verifying that all the systems are operational, that the property matches the condition described in your purchase agreement, and that any seller-agreed repairs have been completed satisfactorily.

Day One: Now You’re a Commercial Property Owner

Congratulations – you own commercial real estate. Now the real work begins. The transition from buyer to owner involves a long list of tasks that need to happen quickly to ensure the property continues operating smoothly.

Insurance coverage needs to be in place before you take ownership, but don’t just transfer the seller’s existing policy. Commercial property insurance should be tailored to your specific situation, ownership structure, and risk tolerance. The seller’s coverage limits might not be appropriate for your situation.

Utility transfers sound straightforward but can be surprisingly complex for commercial properties. Large buildings often have multiple utility accounts, and some utilities require substantial deposits for new commercial customers. Plan for this process to take longer than you expect, and make sure essential services don’t get interrupted during the transition.

Tenant notifications are required in most jurisdictions when ownership changes. Tenants need to know where to send rent payments, who to contact for maintenance issues, and how the ownership change might affect their lease terms. Clear communication during this transition helps maintain positive tenant relationships.

The Reality Check

Looking back on this whole process, it’s clear that successful commercial real estate investing requires a combination of financial acumen, operational expertise, and psychological resilience. The deals that look easiest on paper often turn out to be the most complex in practice. The properties that seem like obvious winners sometimes struggle to perform as expected. And occasionally, a deal that you almost walked away from turns into your best investment.

What I’ve learned over the years is that process matters more than luck. Investors who consistently follow a disciplined approach to property selection, due diligence, financing, and management tend to achieve better results than those who rely on intuition or market timing. That doesn’t mean every deal will be a home run, but it does mean you’ll avoid most of the major mistakes that can seriously damage your returns.

The commercial real estate market continues to evolve in ways that would have been hard to predict even a few years ago. Remote work has fundamentally changed office demand in many markets. E-commerce has disrupted traditional retail real estate. Supply chain issues have affected construction costs and timelines. But the fundamentals of good commercial real estate investing – buying at reasonable prices, conducting thorough due diligence, managing properties effectively – remain constant.