I’ve honestly seen this play out so, so many times. A smart investor, someone capable, they pour not just a ton of money, but their heart and soul into buying or developing a commercial property. And then? Frustratingly, they watch it just… struggle. Sometimes it even fails. More often than you’d think, it’s not a bad business idea or poor day-to-day running of things. Almost always, the core problem comes back to one fundamental thing: the location. I remember advising one client where they thought they had found like the perfect spot for a shop. Seemed bustling, lots of people around. But there was this annoying, hidden infrastructure issue – just no easy parking nearby. Made it just painful for customers to actually get in. Seriously hurt the business there.

Having been actively working in the complex world of commercial real estate for over fifteen years, guiding lots of different investors and businesses, one truth is crystal clear to me: location isn’t just important. It really is, truly, the absolute king in this business category. It’s the bedrock, the very ground success or failure for commercial property is built on. This article is meant to be your practical, real-world guide to actually understanding, evaluating, and using the powerful force that location is. We’re going way past just saying a neighborhood is “good” or “bad.” We’ll get into the serious factors, the need to look super close (hyperlocal!), think ahead about future trends, and more. My point is to give you the viewpoint, the framework you need, to make smart, truly strategic decisions. The kind of decisions that help you really unlock the potential in your commercial property investments.

Not Just “Location”: The Key Things That Count

Everyone in real estate has heard “location, location, location.” It’s catchy, but… what does it even mean? What actually makes a spot “good” for a commercial property, beyond just being generally nice? It’s more complex. Based on my years, here are the things I always look at for a commercial property’s chances of success:

- Demographics: Crucial. Seriously. Who lives or works right around this property? Their ages, incomes, spending habits related to your product/service? A shop for young families needs young families nearby. Luxury retail needs wealthy buyers. Trying to open an upscale store where people don’t buy luxury goods? Probably won’t work, no matter how nice the place is. The people there have to match what you’re selling.

- Accessibility: Gotta ask: how easy, physically, is it for customers, clients, and importantly, employees to actually get to the property? Near major roads, highways? Public transit nearby? Look at traffic flow – heavy traffic can be good for seeing you, but if turning in is a nightmare, people give up. Parking is a huge one, often neglected. Enough parking? Easy access? I always visit locations different times of day just to see the parking and traffic. Tells you more than maps can.

- Visibility: Look, you might have the best thing ever. But if potential customers literally cannot see your business when they go by, you’re invisible. That’s a non-starter, especially for stores. High visibility is essential for most retail; your sign, storefront needs to be seen easily. Maybe less important for offices or industrial where visits are planned. But for anything needing foot traffic, pay attention to street view, sign options, how visible you are from main roads. Your building’s look matters too for visibility and first impression.

- Competition: As important as knowing your customers. Know who your competitors are nearby (direct and indirect). Too many similar businesses? Or is there a gap you can fill? Some competition can be fine, but too much just splits customers and reduces profit for everyone. Be honest: does your business have something truly unique to handle the competition, or will it just get lost?

- Local Economy: A strong, growing local economy is a huge plus for almost any commercial property. Businesses do better when the local economy is good. All property types likely do better, less tenant turnover (if you’re a landlord). Hardest factor to measure/predict accurately, many variables, but worth the research.

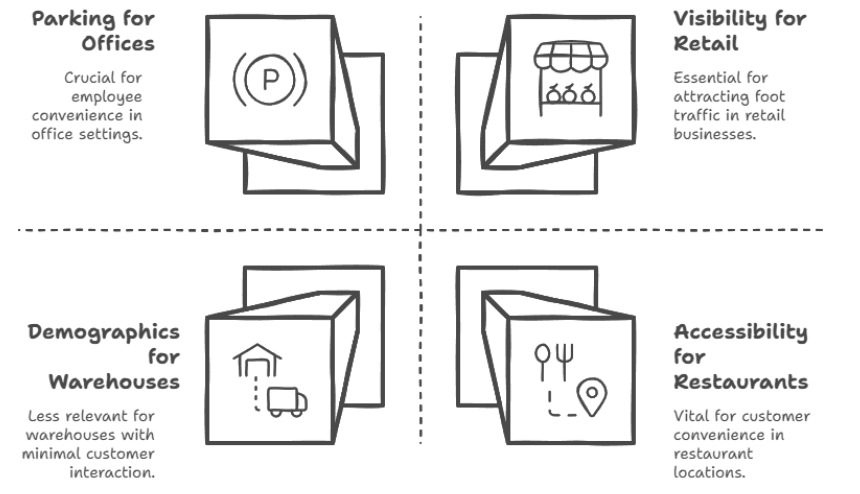

Different types of businesses need different things. A restaurant needs visibility and foot traffic. A warehouse needs easy access to highways, doesn’t care about street visibility. Knowing your business type’s specific needs is key to picking its location based on these factors. I’ve seen businesses boom or fail almost entirely on how well their location fit their specific needs for these things. Your business idea or tenant has to click with the location’s strengths.

Going Deeper: Hyperlocal Analysis

Knowing the general area’s demographics and economy is good, but success often comes down to looking really close at the immediate surroundings. The block, the intersection, the building itself. This “hyperlocal” analysis means going beyond surface info to find hidden chances or problems.

- Foot Traffic Counts: Sounds simple, but it works. Sit nearby (subtly!) and count people walking by at different times. Are they your target customers? Spending time actually counting people at key times is a great, low-tech way to see real pedestrian activity.

- Neighborhood Perception: What do people feel about this block? Is it seen as safe, clean, welcoming? Look at online reviews of neighbors, social media. Sometimes public perception impacts success more than official stats. The feeling of desirability matters!

- Zoning Research: Non-negotiable! What types of businesses are legally allowed here? Zoning directly impacts who you can rent to (as landlord) or if your own business can operate there. Want food trucks on site? Zoning has to allow it for that address.

- Community Meetings: Sounds boring, but going to city council or neighborhood meetings? Amazing source for early info on future plans. New roads? Housing developments? Changes in school zones affecting families? These things happen in meetings before they’re official news and can big-time affect future value/business. Getting this early info through local involvement is a real edge.

I remember a client considering a small retail building. Looked great on paper; growing, seemed promising. But advising them to do a deep hyperlocal dive, we found something big. City planned to re-route a main road away from that property to ease traffic elsewhere. Not announced publicly yet. This would kill foot traffic/visibility. Advised them to walk away. Saved them from probably a very costly mistake. These nuanced, hidden hyperlocal details often need experienced help to uncover.

Location & Tenant Fit: Matching the Business and the Spot

If you own commercial property, or use it for your business, matching the right business to the location is crucial for long-term success. It’s not just filling space. It’s creating a good match, a synergy, between what the location offers and what the business needs. Different businesses need totally different locations:

- Retail: Needs visibility, foot traffic (walking or driving access), easy customer access. Needs to be where the target customer lives/spends time. Fancy clothing store needs foot traffic from stylish people with money. Would fail in a rural, low-income area with a different vibe. Match is everything.

- Office: Often needs accessibility for employees, maybe closeness to related businesses. Area amenities (restaurants, transit) matter for image and attracting staff. Law firm needs downtown near courts. Design agency might want a cool neighborhood location with amenities. Access to transit or highways matters if employees commute from far.

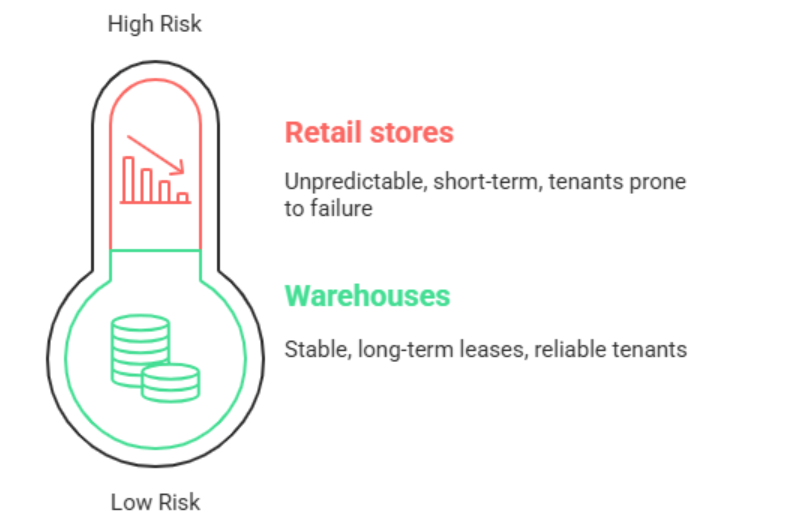

- Industrial: Warehouses, manufacturing. Need easy access to highways, possibly rail/ports. Proximity to suppliers/distributors is a logistics must. Visibility to casual drives is irrelevant. Needs specific industrial zoning for heavy vehicles/processes, maybe environmental checks.

Finding the perfect tenant/user? Needs knowing the location’s features and the business’s exact needs. Match them up for synergy. Helped a client with a struggling retail space. Neighborhood was changing. Old hardware store wasn’t a good fit for new residents. Did analysis, found demand for a specific ethnic grocery many new residents wanted. Recruited that type of tenant. Didn’t just fill space; revitalized the block, brought new traffic, made the property a valuable asset for the community’s real needs. Matching spot to purpose/tenant is vital for long-term value.

Thinking Ahead: Future-Proofing Your Location Choice

Investing isn’t just about now. You have to think ahead. How will this location likely change? Predicting trends is hard, but ignoring potential changes is super risky. How to try and predict?

- Infrastructure: Watch city plans, transit websites, those local meetings. New roads? Transit lines? Utility upgrades? These can totally change access, foot traffic, boost values. City planning reports are key.

- Demographic Shifts: Track growth/decline forecasts, expected age changes, income/education shifts. These shifts create new demand for goods/services, making certain properties more valuable. Census data helps, local planning reports too. (census.gov is your friend!)

- Economic Forecasts: Keep a pulse on forecasts for your area. Expected growth, stagnation, decline? What industries are changing? A strong local economy usually means more demand for all commercial space, driving up rent/value. Declining economy does the opposite. Check local economic development agencies, university reports.

Think about post-WWII suburban growth. Highways, easy mortgages drove millions to suburbs. Businesses that saw and followed that trend thrived there. Those stuck in old city centers struggled. We see similar (though maybe less dramatic) city core revitalization now. Smart investors watch trends, try to find opportunities before everyone else. Key for long-term success.

Real Examples: Location Successes & Setbacks

Best way to show location matters? Real stories. Two examples from my experience: one win, one tough lesson.

Success Story: The Coffee Shop Win. Client wanted a high-end coffee shop. Didn’t go for typical busy downtown (saturated). Instead, looked at a changing, industrial edge of a university town. Skeptical at first. BUT, their research showed lots of students/young pros moving into this industrial area due to high housing costs elsewhere. And zero good coffee options there. By opening a cool shop with great coffee/Wi-Fi in that specific, empty spot, they tapped into ignored demand. Became a real community hub for that group, brought traffic to the block. Lesson: Look beyond obvious spots. Find unmet needs within a specific population in areas others miss.

Failure Analysis: The Big Box Issue. Large national retailer built a huge store just outside a growing suburb. On paper, area growth looked good. Where they messed up: didn’t factor in two big things increasingly affecting that specific site and retail generally: terrible, growing traffic congestion getting to the store, and the rise of online shopping. The location became a nightmare to access in traffic, scaring off convenience-focused shoppers. Online shopping made the store’s typical product selection less compelling. Stressors combined, store just closed after a few years. Lesson: In modern retail, location and business model MUST work together and account for factors like changing traffic/tech trends. Location can’t be a stressor, has to support success.

These show location isn’t just knowing the area. It’s picking the right method for that property/market, doing full due diligence, getting expert help. Every property is unique; need nuanced, thoughtful approach.

Bottom Line: Get Location Right Today

So, location in commercial real estate? Way more than an address or “good” neighborhood. It’s a complex system of demographics, access, visibility, competition, economy, local details, and thinking ahead. Understanding how it works is what makes or breaks your investment. Grasping key drivers, doing hyperlocal dives, matching business to location, trying to predict trends – this sets you up for success. Always look beyond the surface. Dig deep into those local specifics.

Please, don’t gamble your commercial real estate investment on a gut feeling or partial info. If you’re ready to seriously improve your location strategy, get a real edge by making truly informed choices, I’m here. I do consultations to help you assess your needs, analyze potential properties using these methods, and build your winning strategy. Let’s work together. Turn your CRE goals into solid, successful, profitable realities. Contact me today. Let’s look at your next potential location.