It’s kinda interesting, right? When you look at data for commercial real estate where triple net (NNN) leases are involved, you see a pretty big jump over the last ten years – maybe 40% or something like that increase in this market. That’s not just a little blip; it really shows they’re getting more and more popular in the CRE world. After over fifteen years helping investors navigate commercial property, I can tell you one type that always, right away, gets people interested: the good old NNN lease.

In this guide, I want to do more than just define it. I want to really show you what triple net leases are all about. Think of this as a clear, practical roadmap to understand these unique types of investments. My main point is to give you the insights to figure out honestly if NNN leases actually fit your specific financial goals, how much risk you’re okay with, and how much you actually want to be involved in managing property day-to-day. Ultimately, empowering you to make smart choices and build a real estate portfolio that works for you.

Breaking Down Triple Net (NNN) Leases

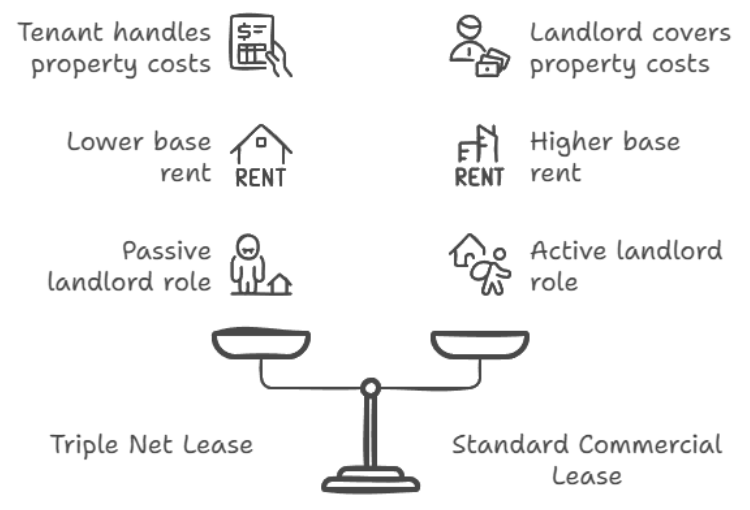

Alright, let’s get straight to it: what exactly is a “triple net lease”? It’s a specific kind of commercial lease agreement. Basically, it puts the responsibility for three main property costs squarely on the tenant. Those three are the “triple” part: property taxes, building insurance, and routine maintenance and repairs. So, the tenant acts almost like a pseudo-owner in handling those costs that come directly with owning a property.

This is where it differs big time from a standard commercial lease (sometimes called a gross lease). In a standard lease, the landlord pays for taxes, insurance, most maintenance. They usually wrap those costs into the base rent. With an NNN lease, though, the tenant typically pays a lower base rent, but then they separately and directly pay the property taxes, the building insurance bills, and most (or all, depending on the specific lease) maintenance/repair costs. Picture a big national pharmacy chain in a standalone building with an NNN lease. They pay the agreed base rent, but they also directly handle forwarding payment for annual taxes, paying the insurance premium, and covering all repairs – from landscaping to roof issues. They handle the property’s operating costs beyond the rent much more. (Little side note: legal experts, like those on rentprep.com, always stress how important a super clear, legally solid NNN lease document is for landlords).

Bottom line: the landlord’s job in an NNN lease is way simpler. Usually, you’re just responsible for truly major structural stuff (check the lease terms!) and making sure the tenant follows the lease and, crucially, pays the rent on time. You step into more of a passive investor role, focusing on collecting rent while the tenant handles the day-to-day property costs and upkeep.

Why Everyone Likes NNN Leases: The Big Draws

So, what makes NNN leases so popular? They seriously attract people looking for that combo of steady, predictable income and way less management stress. Several things make them so attractive.

First off, and for many, this is the main reason: they offer pretty genuine passive income potential. Since the tenant handles most costs and management, landlords get a much more hands-off investment experience compared to, say, running apartments or a multi-tenant retail spot yourself. This is where you hear the “mailbox money” phrase. You get your check without dealing with tenant calls about a leaky faucet or a broken AC unit. This free time lets investors focus on other work or life stuff, or buy more properties without getting swamped by management duties.

Second big thing: stability from long leases. NNN leases often lock in tenants for a long time – like 10, 15, even 20+ years. That offers incredible stability in your income stream. Pair a long lease with a “creditworthy” tenant (a financially strong one, maybe a big national company), and you’ve got a consistent, reliable income stream for years to come.

Finally, besides the steady income, the property itself can appreciate. While you’re collecting rent, the NNN property can go up in value. Happens due to location improvements, economic growth, or just more investor demand for NNNs. I had a client with an NNN property leased to a big fast-food brand. Got steady passive income for 15 years. Location got better, chain drew traffic, property value nearly doubled when they sold. Combination of income and appreciation. (Checking tenant creditworthiness, like discussed on sites like westwoodnetlease.com, is key to this stability!).

But Be Careful: Risks and Challenges

Okay, benefits are great, and they are real. But you have to be realistic. NNN investing has risks and challenges, like any investment. These properties aren’t immune to downsides.

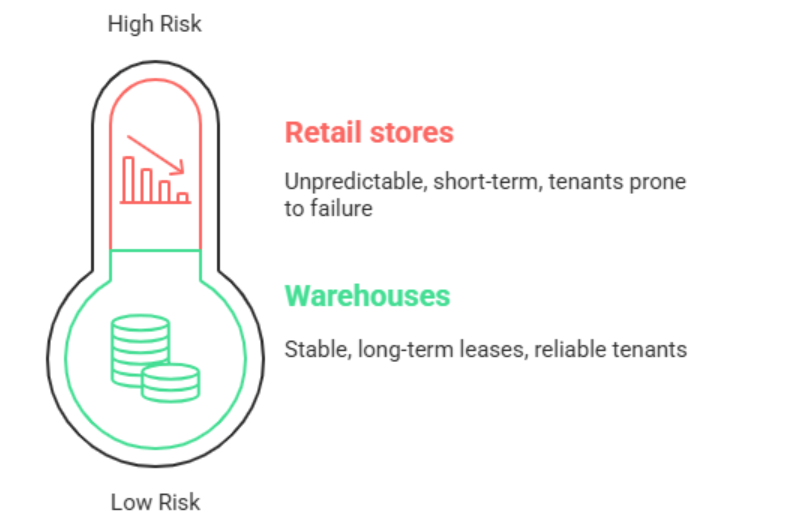

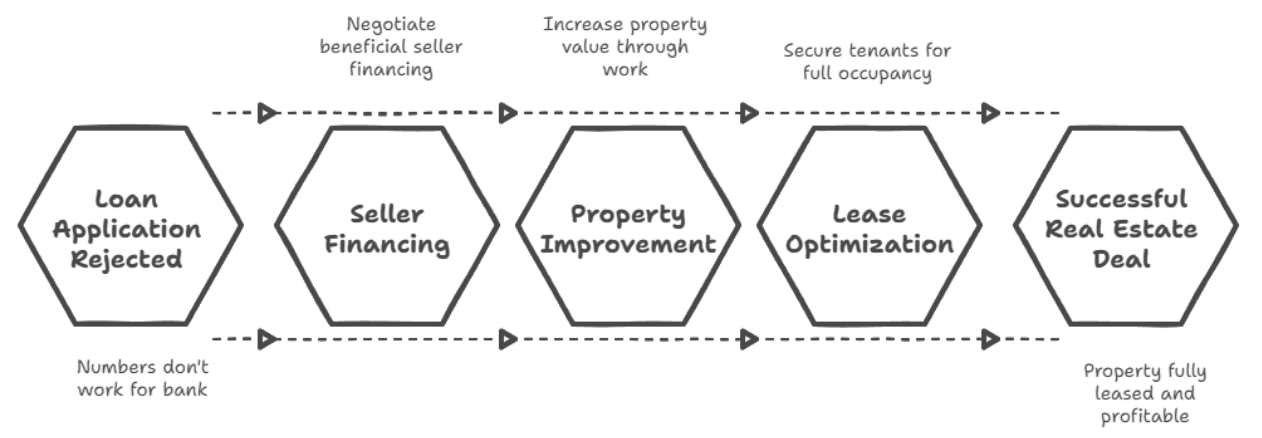

Biggest concern: tenant vacancy risk. What if the tenant leaves before the long lease is up? Business fails? Doesn’t renew? Suddenly you (landlord) have to find a new tenant. Means lost rent if it sits empty, plus costs for marketing, maybe fixes, still paying some bills while it’s vacant. Market changes can still lower the property’s value or future rent potential when the lease does finally end.

Because of this, serious due diligence before you buy is crucial. Non-negotiable. Screen tenants meticulously – check their financials, their business health. Research the local market way beyond just the property’s corner. Get independent appraisals. Checking the tenant’s financial strength is essential. A weak tenant hugely increases default/vacancy risk. As sites like realcapanalytics.com emphasize, making sure that tenant can actually afford those long-term payments is vital. Is a stronger parent company guaranteeing the lease? That adds security.

I advised against one NNN investment leased to a smaller, regional restaurant chain. Return looked good on paper, tempting. But research showed the chain was struggling elsewhere, even paid rent late sometimes. Despite the tempting numbers, we saw the high tenant risk. Walked away, found a more secure property after doing that deeper check. Lesson: NNNs offer passive income, but you must manage risk proactively before investing. Due diligence is your strongest tool, maybe mixed with some healthy skepticism on super high projected returns.

How NNNs Stack Up Against Other Investments

Deciding where to put money is big. NNN leases are just one option. How do they compare?

- NNN vs. Traditional Rentals: Like owning apartments or houses. Way more hands-on for the landlord. Finding tenants, doing all the maintenance small and large, handling complaints. Time consuming, can be stressful. Rentals might offer higher returns sometimes, but require way more personal time and management. NNNs are hands-off because tenant handles upkeep/costs. Also, NNNs have those long (10-20+ year) leases versus standard 1- or 2-year residential ones. More income stability long-term.

- NNN vs. REITs: REITs are very different. You invest in real estate (even NNN properties) but buy shares in a company, not directly own physical property. You get diversification (part of many properties) and liquidity (can trade shares easily). But you give up direct control. Don’t pick the property, don’t manage tenants. Return is from share price and dividends, not your direct property value increase. NNNs are less liquid than REIT shares (selling a building takes months). REITs for diversification/easy trading; NNNs for stable direct income from a tangible asset you control.

- NNN vs. Ground Leases: Another specific commercial lease type. You only lease the land. Tenant builds/owns the building on it. Ground leases can be very predictable income, even fewer responsibilities maybe than NNN (tenant handles the building). But rent is lower, generally lower returns. Long-term plus for landlord: building usually reverts back to landowner free at end of very long lease.

No single “best” path. Depends on your goals, risk tolerance, how much time you want to spend managing. Understanding types like these (and others like modified gross leases, mentioned on sites like westwoodnetlease.com) gives savvy investors more options for their portfolio.

Is NNN Right for You? Ask Yourself…

Thinking NNN might fit? Get honest about your situation and why you invest. Ask yourself:

- Income goals? Need steady, passive income to add to what you have? Or trying to replace your main income fast? NNNs are for patient, long-term income, not quick riches.

- Risk tolerance? Okay if a tenant leaves early? How do you feel about potential value fluctuation? Or prefer super safe, even low yield? You can lower NNN risk with research, but accurate risk assessment needs experience.

- Time for management? Want truly passive, just collect checks? Or okay being involved with tenant issues if needed? “Passive” for NNN is comparative. You should still check in, get reports, ensure tenant maintains things per lease. Not usually zero effort.

- Long-term plan? Buying to sell quickly (flip)? Or hold for years of income? NNNs are much better for long-term hold. Transaction costs eat short-term profit. Value is in years of income.

Answer honestly. Gives insight if NNN fits your needs, personality, finances. If you want passive long-term income, are comfy with moderate risk (especially with good tenant), NNNs could fit. If you need high potential returns (higher risk!), or love hands-on management, other options might be better. Consider specific income needs too, as sites like westwoodnetlease.com might prompt.

Summing It Up: Getting NNN Right

To wrap up, triple net leases offer a compelling way for investors to get relatively passive income and build wealth in commercial real estate. Understanding what they are, weighing the passive income against risks like vacancy, and comparing them to other choices helps you figure out if NNNs align with your goals. And seriously, thorough due diligence before you sign is always critical for lowering risk and getting the best long-term return. Thinking about selling later? Looking into strategies like a 1031 exchange (like on sites such as 1031ex.com) can be smart long-term NNN planning.

Don’t just jump into NNNs blindly. If you’re ready to take the step, get a competitive edge through informed decisions, I’m here. I do personalized consultations to help you assess your goals, analyze potential NNN properties, and develop a winning strategy for you. Let’s work together. Let’s see how we can turn your CRE goals into real, income-producing properties. Contact me today! Let’s chat about your investment journey.