Why consider industrial real estate?

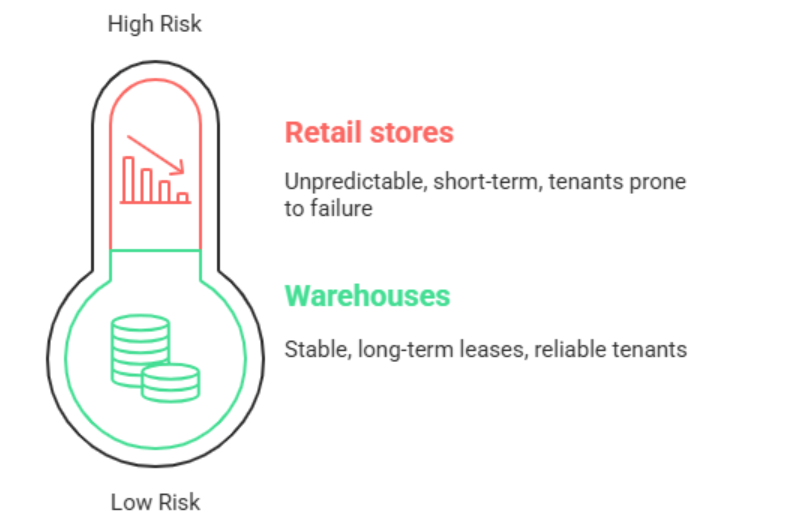

Since Amazon changed how we all shop, industrial real estate has been on fire. While office buildings sit half-empty and retail stores keep closing, warehouses and distribution centers are in crazy high demand.

Industrial properties aren’t glamorous, but they make money. We’re talking about longer leases, tenants who actually pay their rent, and way less drama than dealing with residential renters or retail tenants who bolt when times get tough.

If you’re thinking about industrial real estate, you need to understand what drives the numbers. The key is knowing which properties actually work and which ones will leave you holding the bag.

How much can you actually make?

Your returns depend on what you buy and where you buy it. A crappy warehouse in the middle of nowhere won’t perform like a modern distribution center near a major highway.

Here’s what the numbers look like for different types of industrial properties, based on recent market data. Keep in mind – these are averages. Your actual results will vary depending on your negotiating skills, timing, and whether you get stuck with problem tenants.

Also remember that cap rates are just the starting point. Factor in financing costs, vacancy periods, and the inevitable surprise repairs that eat into your profits.

What different industrial properties actually return

| Property Type | Cap Rate Range | Typical Lease Length | How Hard to Fill | Management Hassle |

|---|---|---|---|---|

| Big Distribution Centers | 4.5-6.5% | 10-15 years | Pretty easy | Low |

| Mid-Size Warehouses | 5.5-7.5% | 5-10 years | Depends on location | Manageable |

| Light Manufacturing | 6.0-8.0% | 7-12 years | Can be tricky | More involved |

| Multi-Tenant Flex | 6.5-8.5% | 3-7 years | Higher turnover | Pain in the ass |

| Last-Mile Delivery | 4.0-6.0% | 5-10 years | Hot right now | Pretty easy |

Reality check: These numbers assume you know what you’re doing and don’t overpay.

Your options for getting in

You’ve got several ways to play the industrial game. Each has trade-offs, and honestly, most beginners mess this up by jumping into the deep end too fast.

Buy properties directly

Makes sense if…

You’ve got serious money and want full control.

Buying industrial properties outright gives you the biggest upside, but it’s not for amateurs. You need at least a million bucks to get into anything decent, plus the stomach for dealing with commercial tenants, zoning issues, and environmental headaches.

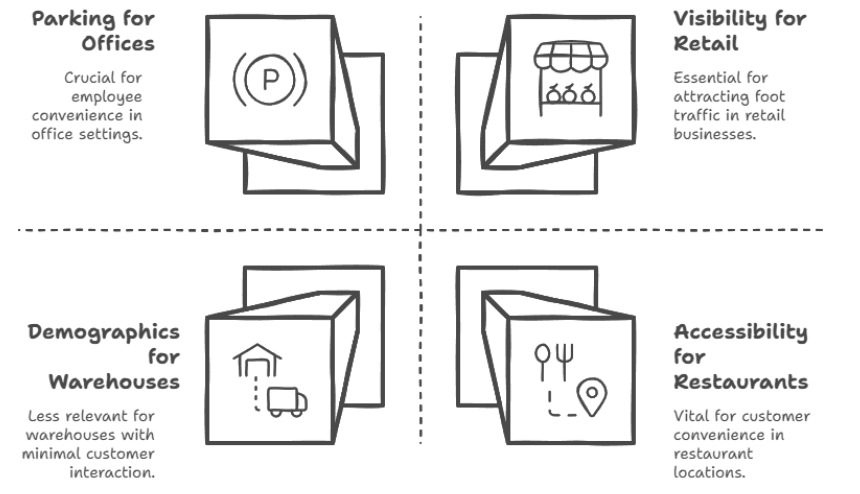

The smart money focuses on properties near major highways, ports, or airports. Location isn’t everything in industrial – it’s the only thing. A great building in a terrible location will bleed money.

Here’s what you’re looking at:

- Entry point: $1-5 million minimum for quality stuff

- Due diligence: Better hire experts or you’ll get burned

- Day-to-day: You’ll need property management unless you want constant headaches

- Financing: Banks will want to see your financial statements and they better look good

Industrial REITs

Makes sense if…

You want exposure without the hassle.

REITs are the easy button for industrial investing. Companies like Prologis own billions of dollars worth of warehouses and distribution centers. You buy shares, they handle everything, you get dividends.

The downside? You’re along for the ride. When the REIT makes dumb decisions, you eat the losses. Plus, REIT shares bounce around with the stock market, which sometimes has nothing to do with how the actual properties are performing.

REIT pros:

- Start with whatever you can afford

- Professional management (hopefully)

- Spread across lots of properties

- Easy to buy and sell

- Regular dividend checks

REIT cons:

- No control over what they buy or sell

- Stock price swings around

- Management fees eat into returns

- Tax treatment isn’t as good as owning directly

Real estate syndications

Makes sense if…

You want bigger deals but don’t have massive capital.

Syndications pool money from multiple investors to buy properties none of them could afford alone. Usually need $25K-$100K to get in. The sponsor finds the deal, manages everything, and splits the profits.

Problem is, you’re betting on the sponsor’s skills. Some are great, others will lose your money. Do your homework on their track record before writing any checks.

Watch out for:

- Track record: How many deals have they actually completed?

- Fee structure: Some sponsors charge fees coming and going

- Timeline: Most hold properties 3-7 years whether you want out or not

- Accreditation: Many require you to be an accredited investor

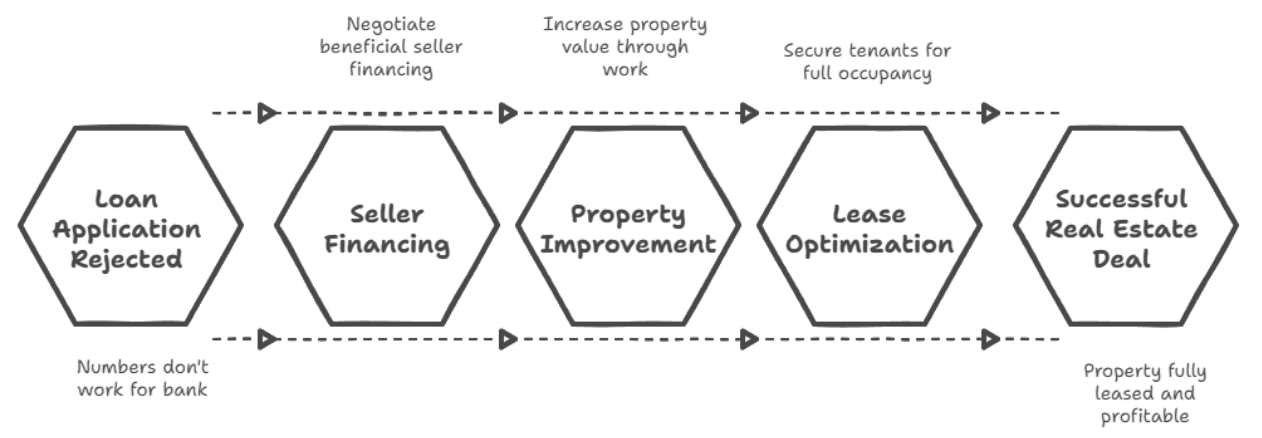

Development and fix-up projects

Makes sense if…

You’re experienced and want higher returns.

Building new industrial properties or fixing up old ones can pay off big, but it’s not beginner territory. Too many things can go wrong – cost overruns, permit delays, market changes while you’re still under construction.

If you’re new to this, partner with someone who’s done it before. Better to split profits than lose everything learning expensive lessons.

What’s driving all this demand

Understanding why industrial real estate is hot helps you spot opportunities and avoid getting caught when trends shift.

E-commerce isn’t slowing down

Every time someone buys something online instead of driving to a store, it creates demand for warehouse space. All those packages need somewhere to get sorted and shipped from.

The numbers don’t lie – online sales keep growing double digits year after year. Even when the economy hiccups, people still order stuff online. It’s become a habit that’s not going away.

Companies want backup plans now

COVID taught businesses that lean supply chains break when shit hits the fan. Now everyone wants extra inventory sitting around “just in case.” That inventory needs a place to live.

Plus, companies are bringing manufacturing back from overseas. Turns out relying on factories halfway around the world has downsides. This creates demand for both manufacturing space and nearby distribution centers.

Speed delivery is everything

Nobody wants to wait a week for their Amazon order anymore. Two-day shipping is the new normal, one-day is better. This forces companies to put distribution centers closer to where people actually live.

These “last-mile” facilities are smaller than the massive Amazon warehouses, but they’re in prime locations. Prime locations mean higher rents.

The risks nobody talks about

Every real estate guru will tell you industrial is “safe.” It’s not. Here’s what can actually go wrong.

Markets get oversupplied

When industrial gets hot, developers start building everywhere. Too much new supply can kill your rent growth and leave you competing with brand-new buildings using your old, tired property.

Watch the construction pipeline in your market. If there’s a ton of new space coming online, be careful.

Location becomes worthless

Industrial properties live and die by location. Changes in traffic patterns, new highway construction, or shifts in population can make your previously perfect location irrelevant.

I’ve seen properties lose half their value when a new highway bypass made the old route obsolete.

Tenants customize everything then leave

Some industrial tenants will modify your building for their specific needs. Great while they’re paying rent, but when they leave, you’re stuck with a building nobody else wants.

Try to keep modifications reasonable or make sure the tenant pays to return the space to standard condition when they leave.

Technology makes buildings obsolete

Modern warehouses need high ceilings for automation, stronger floors for heavy equipment, and better power systems. Buildings that can’t handle new technology become second-class properties.

Before buying older industrial properties, think about whether they can adapt to changing tenant needs.

Getting started without screwing up

Start by figuring out what you actually want Are you looking for steady income or big appreciation? How much can you actually afford to lose? How hands-on do you want to be? Answer these questions before you start looking at deals.

Learn your local market Industrial real estate is local. What works in Atlanta might bomb in Phoenix. Spend time understanding your market’s drivers, major employers, and transportation infrastructure.

Build relationships before you need them You’ll need brokers, lenders, property managers, contractors, and attorneys. Start building these relationships before you’re under pressure to close a deal.

Don’t try to hit home runs right away Your first industrial deal should be boring and safe. Learn the business on smaller, simpler properties before going after the complex stuff.

Common questions (and honest answers)

How much money do I really need to get started? For REITs, whatever you’ve got. For syndications, usually $25K-$100K. For direct ownership, figure at least $1 million for anything decent. Don’t forget closing costs, due diligence expenses, and reserves for unexpected problems.

Is industrial easier than residential rentals? In some ways, yes. Longer leases mean less turnover, and commercial tenants usually handle more of the maintenance. But the deals are more complex, due diligence is harder, and when things go wrong, they go really wrong.

What makes a location good for industrial? Access to highways, proximity to airports or ports, available workforce, reasonable labor costs, and business-friendly local government. Avoid areas where it’s hard to get permits or where regulations change constantly.

Should I worry about e-commerce slowing down? E-commerce growth might slow from the crazy pandemic levels, but it’s not going backward. People aren’t going to suddenly stop ordering stuff online. The question is whether there’s enough new supply being built to meet demand.

Can I start with industrial if I’m new to real estate? Honestly? Probably not directly. Industrial deals are more complex than residential. Consider starting with REITs or smaller syndications to learn the business before buying properties yourself.